Betting Tax in Africa Overview

Many governments have introduced taxes on offline & online betting! On this page we want to bring some light into the different tax rates for sports betting in Kenya, Ghana, Nigeria, Tanzania, Uganda, Zambia and some other African Countries.

Before you place your bets and start imagining that big win, there’s one thing you need to consider – the dreaded betting tax. Yes, just like in many other parts of the world, African countries also impose taxes on betting activities. But fear not! In this article, we will explore all aspects of betting taxes in Africa and even reveal some hidden gems – betting sites without tax! From finding safe betting tax, to navigating the complexities of paying taxes on stakes or winnings, this comprehensive guide has got you covered.

Main goal of this article: Help you to avoid paying taxes on your Bets! Here is how you can save the tax and have more money in your pocket 💰💰💰🤑🤑🤑

Taxes on Betting in your Country

| Country | Tax rate on Stake (%age) | Tax rate on Wins (%age) | Online/Offline | Bookies without Tax | Official Link |

|---|---|---|---|---|---|

| 🇰🇪 Kenya | 12.5% | 20% | Both | Paripesa | BCLB Kenya |

| 🇬🇭 Ghana | NO | 10% | Both | Paripesa | Gaming Commision of Ghana |

| 🇹🇿 Tanzania | NO | 10% | Both | No Bookie | Tanzania Revenue Authority |

| 🇺🇬 Uganda | NO | 15% | Offline | 1xbet Melbet Betwinner Paripesa | Uganda Revenue Authority |

| 🇿🇲 Zambia | NO | 15% | Both | Betwinner | Zambian Gambling Law |

| 🇳🇬 Nigeria | NO | NO | No Tax | All Bookies | not available |

Betting sites without tax

If you’re a punter looking to maximize your profits, the idea of betting sites without tax might sound like music to your ears. These are platforms where you can place your bets and potentially walk away with all of your winnings, without having to worry about any deductions for taxes. Sounds too good to be true? Well, It’s not a pipe dream, my friend. We’ve done some serious investigating into the African betting industry and uncovered some hidden gems – bookmakers that have found a way to offer their services without the dreaded betting tax imposed by the countries they operate in. Trust us, you won’t want to miss out on this!

Betting site without tax in Ghana 🇬🇭 & Kenya 🇰🇪

- Avoid to pay Tax rate of 12.5% on stake and 20% on your winnings in Kenya 🇰🇪 @ Paripesa

- Avoid to pay Tax rate of 10% on your winnings in Ghana 🇬🇭 @ Paripesa

In Africa, Paripesa emerges as an enticing choice. With its simple Paripesa registration available in numerous African nations, including Ghana, Kenya, Nigeria, Uganda and Zambia, this platform allows users to place bets without being subject to extra taxation. By offering the allure of tax-free winnings, they create a competitive advantage over other bookmakers who charge taxes. It’s all about giving players an incentive to choose them over the rest. So, why wait and why not SWITCH from your current bookmaker (paying tax!) to open a new betting account at Paripesa?

Betting site without tax in Zambia 🇿🇲

- In Zambia, a 15% withholding tax is placed on all licenced bookmakers

- But some bookmakers have opted to pay-off the imposed tax for customers

- Customer’s receive a refund of the 15% deducted tax when bets are won

- The most popular bookmakers that offer safe betting tax in Zambia are:

- Betwinner

- Sportybet

- Paripesa

But why would this betting sites choose to pay-off the imposed tax for customers? The answer lies in becoming a safe betting platform for Zambians and other international! By choosing these tax-free bookmakers in Zambia, you can indulge in safe and enjoyable betting experiences. Do you already have an account with any of these bookmakers? Well, we have curated a guide on the hassle-free Betwinner registration – take a look and join in on the tax-free gambling experience!

Betting sites without tax in Uganda – 🇺🇬

- Uganda has its own unique twist on offering a safe betting tax.

- Unlike other countries, bookmakers don’t pay-off imposed tax on winnings

- But the good new is that, Government only levied taxes on offline betting

- Betting online comes without tax on your winnings or stakes

- One popular choice among Ugandan bettors is 1xbet – create an account with simple 1xbet registration!

- Other bookmakers that also help punters to escape the clutches of online betting taxation in Uganda are:

- Betwinner – find our more about the Betwinner registration!

- Melbet – Sign up with hassle-free Melbet registration!

- Betpawa

- Fortbet

- Ababet

So, if you prefer placing bets through digital platforms rather than visiting brick-and-mortar establishments, the best betting companies in Uganda might be the perfect destination for tax-free wagering.

Safe betting tax in Nigeria – 🇳🇬

Apart from these bookmakers which pay-off taxes for punters, other African countries also run their betting industries without imposing any tax on their customers’ stakes or winnings – Nigeria serves as a prime example. Unlike many other countries, Nigeria does not have any legal laws in place that impose taxes on betting activities. This makes it an attractive destination for both local and international bettors. Whether you prefer online or offline betting, with no taxes on bets won or stakes placed, Nigerian bettors can fully enjoy their winnings without worrying about deductions.

This approach has allowed the best betting sites in Nigeria to thrive and provide safe betting options for Nigerians and even customers outside the shores of Nigeria! Essentially, the country has found alternative ways to generate revenue instead of relying solely on taxing their customers. However, it’s essential to note that before signing up with any bookmaker, it’s crucial to read through their terms and conditions regarding taxation practices. Keep in mind that tax regulations vary by country and jurisdiction, so bettors must familiarize themselves with the local laws regarding gambling taxation.

What means betting taxes?

Betting taxes, as the name suggests, refer to the taxes imposed on betting activities. When you place a bet, whether it’s at a physical bookmaker or through an online platform, there may be certain tax implications involved. These taxes can take various forms and can be applied differently depending on the country or jurisdiction. In some cases, you may have to pay tax on your stake. In other instances, taxes are levied only on winnings!

- Tax on Stake: This is when a slice of customer’s stake is deducted as tax – that is, a percentage of the amount of money you wagered. Many countries around the world have been exploring the idea of implementing a percentage withholding tax on players’ wagers for various types of gambling activities, including sports betting, casino games, and virtual gaming. Interestingly, Kenya is currently the only country in Africa that has successfully implemented this tax. The government of Kenya imposes a 12.5% withholding tax on customers’ stakes for all types of gambling activities. This means that if a player places a bet of Ksh 1000, Ksh 125 will be withheld as tax, leaving the player with a net stake of Ksh 875.

- Tax on Winnings: In contrast to other countries, several African countries have implemented a withholding tax on winnings obtained by gamblers. This tax is usually a percentage of the total amount won. The tax is typically deducted from the player’s winnings only after they hit a jackpot – which means that if they don’t win anything, they don’t owe any tax. This practice is common in several African nations, including but not limited to Ghana, Kenya, Tanzania, Uganda, and Zambia.

The rates at which these taxes are applied vary from country to country (check table up). For some nations, betting tax can range anywhere from a few percentage points up to double-digit figures. This means that depending on where you reside or place your bets, your potential profits could be significantly impacted. Some countries also have a fixed tax rate for all types of betting activities, while others have different tax rates for different forms of gambling.

You can nullify the impact of these betting tax on your overall betting experience by taking advantage of the betting sites registration bonus – receive extra free cash to play more!

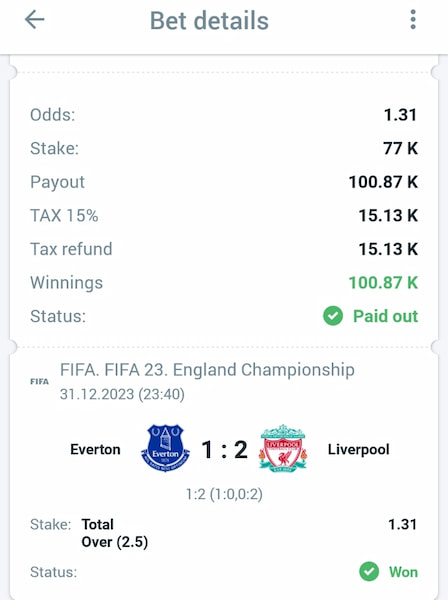

Calculation example betting taxes

If you’re interested in learning about taxes on gambling winnings, we can help you out. Let’s embark on a brief exploration of a sample tax imposed in Zambia and delve into its features and how it is calculated. As shown above, the different components that constitute this taxation framework encompass the notion of odds, stake, payout, tax percentage, tax refund, and winnings.

- First, there are the odds, which refer to the total odds of the bet

- Then, there’s the stake, which is the amount that’s wagered

- The payout is the total amount of winnings that the bettor receives

- Now onto the crux of our discussion: tax! In Zambia, a 15% portion is levied on payouts as per governmental regulations. This is calculated as: 15% x Payout (15/100 x 100.87 = 15.13K)!

- However, there’s also a tax refund at Betwinner.com Africa in Zambia, for which is the amount of tax that’s paid back to the bettor

- Lastly, there are the winnings themselves, which refer to the amount that is withdrawable

Government reasons for betting taxes

Government reasons for betting taxes can vary depending on the country and its specific circumstances. Some common reasons are:

- To generate revenue for the government, particularly in countries where gambling is prevalent. Taxing betting activities allows governments to collect a portion of the profits made by punters and use it towards public services and infrastructure

- Another reason for implementing betting taxes is to regulate the industry and protect consumers. By imposing taxes, governments can ensure that only licensed and reputable bookmakers operate within their jurisdiction. This helps prevent illegal gambling activities, such as money laundering or fraud, while also promoting fair play and responsible gambling

- Furthermore, some governments view taxing betting activities as a means of addressing social issues associated with excessive gambling. By levying taxes on bets won or wagered amounts, authorities aim to discourage problem gambling behaviors and reduce the potential negative impact on individuals and communities

- Betting taxes can be seen as a way to create a level playing field between traditional offline bookmakers and online platforms. Online operators often enjoy lower costs due to reduced overheads compared to brick-and-mortar establishments. Imposing taxes ensures that both types of bookmakers contribute fairly towards tax revenues

Government reasons for implementing betting taxes are multifaceted – from generating revenue to protecting consumers and addressing social concerns related to gambling addiction. These factors come together in shaping policies surrounding taxation in the African betting industry.

History of betting taxes

The history of taxes on betting is a fascinating journey that spans across centuries and continents. In many countries, the introduction of betting taxes can be traced back to the need for governments to generate revenue. One of the earliest instances of betting taxes in Africa can be traced back to colonial times. During this period, European settlers introduced different forms of games and lotteries to African communities as a means to raise funds for their colonial projects. For example, in South Africa during the late 19th century, horse racing was a popular form of entertainment among European settlers, and they imposed taxes on races to fund their expenses.

In the post-colonial era, many African countries continued with this practice by implementing various forms of gaming or gambling taxes. In some cases, these taxes were used to generate revenue for development projects or social welfare programs. For instance, Kenya introduced its first betting tax in 1966 as part of its lottery ordinance that aimed at funding education initiatives. In recent years, with the rise of online sports betting and casinos across Africa, governments have been under increasing pressure to regulate these activities and ensure that they contribute significantly to national revenues. Many African countries now have legislation in place that directly imposes taxes on these types of gambling activities.

Over time, different approaches have been taken by various countries when it comes to taxing bets. Some countries levy taxes on both the stake and winnings, while others only tax on bets won. In Kenya, a 20% tax on betting was introduced in 2014, but this was reviewed in 2016 following protests from industry stakeholders. Other countries such as Ghana, and Uganda have also implemented taxes on betting activities in recent years.

While the history of betting taxes in Africa may have started under colonial influence, it has evolved significantly over time. Today, these taxes play an essential role in generating revenue for governments and regulating the industry, and there are ongoing efforts towards achieving unified policies on betting taxation across the continent.